How can incentives reduce the cost of going solar?

One of the most powerful tools for improving solar’s return on investment is leveraging available financial incentives. Thanks to federal legislation and state-level programs, many commercial solar projects today benefit from reductions in gross cost through tax credits, depreciation, and renewable energy credits.

But incentives aren’t one-size-fits-all. They vary based on project ownership, location, system design, and even who will use the energy. This section will walk you through the most important incentives and how Melink Solar helps clients take full advantage of them, whether you’re a for-profit business, a public institution, or a nonprofit organization.

Key Commercial Solar Incentives

| Incentive Type | Description | Who Can Benefit |

| Investment Tax Credit (ITC) | 30% credit on eligible project costs | Businesses, nonprofits (via Direct Pay) |

| Bonus ITC Adders | Additional 10–20% if project meets criteria (e.g., low-income, domestic content, apprenticeship) | Select projects with qualifying design or location |

| MACRS Depreciation | Accelerated tax depreciation to recover cost quickly | For-profit businesses |

| Direct Pay (Refundable Credit) | Nonprofits and tax-exempt entities can receive ITC as a cash refund | Schools, governments, religious institutions, nonprofits |

| SRECs & State/Local Incentives | Solar Renewable Energy Credits and grants in certain states | Depends on state, utility, and policy landscape |

Federal Incentive Update (Big Beautiful Bill, signed July 4, 2025) #

30 % Investment Tax Credit (ITC) — Section 48E

The 30 % base ITC for commercial solar is still available, along with the 10-percentage-point Energy-Community and Domestic-Content bonus adders. However, the bill imposes a much shorter window to qualify:

| Milestone | What you must do | Result |

|---|---|---|

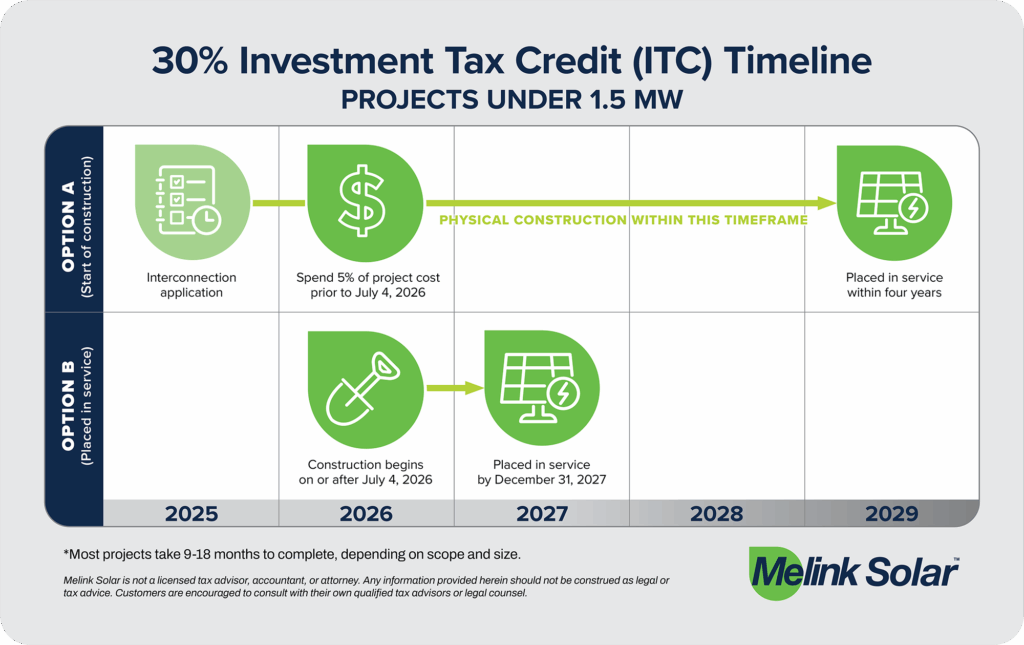

| Path 1 — Begin Construction by July 4, 2026 | Start physical work of a significant nature or meet the 5% Safe Harbor test* | Full 30% ITC (plus any applicable adders) and it must be placed in service within four years |

| Path 2 — Finish Construction by Dec 31, 2027 | If you miss the start-by-2026 window, you can still qualify only by placing the project in service by this date | Full 30% ITC (plus adders) |

| Miss both deadlines | — | No federal ITC for commercial solar |

100 % Bonus Depreciation Restored

The bill permanently revives 100 % first-year bonus depreciation for “qualified property” acquired on or after January 20, 2025. Solar project owners may instead elect 60% or 40% first-year expensing if that better fits their tax strategy.

Direct (Elective) Pay for Tax-Exempts

Tax-exempt entities—including nonprofits, schools, and municipalities—can still elect Direct Pay for the 30% ITC and applicable adders. The same start-by-2026 / placed-in-service-by-2027 timelines apply.

How to Lock In Your Credit

Under IRS Notice 2025-42 issued in response to Executive Order 14315:

- Projects greater than 1.5MW-AC must meet requirements of the Physical Work Test (Physical Work Test – Start physical work of a significant nature on-site or off-site) or

- Projects less than 1.5MW-AC can meet Five Percent Safe Harbor Test (Five Percent Safe Harbor – Pay or incur ≥ 5% of total project cost during the year construction begins)

Meeting either test before July 4, 2026 secures the full credit, provided you maintain continuous progress (continuity rules still apply).

Take-away: Projects that act quickly can still capture the full 30% ITC, bonus depreciation, and adders—but the clock is ticking. Engage your tax and finance teams now to prove “begun construction,” lock in Safe Harbor, and avoid missing the new deadlines.

This summary is for general information only and not tax advice. Consult a qualified tax professional to confirm how the Big Beautiful Bill applies to your specific project.

Incentive: MACRS Bonus Depreciation #

In addition to the ITC, for-profit businesses can take advantage of accelerated depreciation under the Modified Accelerated Cost Recovery System (MACRS). This allows solar system costs to be depreciated over five years.

Bonus depreciation rules have changed under current tax law:

- 40% bonus depreciation applies for projects placed in service in 2025

- The bonus percentage steps down each year unless extended

MACRS, combined with the ITC, can significantly reduce the net cost of solar in the first few years of operation – great for organizations focused on fast ROI.

Incentive: Direct Pay for Nonprofits and Public Entities #

Under the Inflation Reduction Act, nonprofit and tax-exempt entities can now access the full 30% ITC as a refundable tax credit, even though they don’t owe federal taxes.

This “Direct Pay” option enables organizations like:

- Schools and universities

- Religious institutions

- Local governments and municipalities

- 501(c)(3) nonprofits

…to receive the tax credit as a cash refund, leveling the playing field with for-profit solar owners. This change has opened the door for thousands of mission-driven organizations to pursue clean energy with real financial returns.

Incentive: SRECs, Grants, and State-Level Incentives #

Many states offer their own solar incentive programs – some generous, others limited. Common programs include:

- SRECs (Solar Renewable Energy Credits) that pay you for the clean energy your system produces

- Grants or performance-based incentives

- Sales tax or property tax exemptions

- Net metering policies that enhance ROI (covered in Section 2.2)

To find what’s available in your state or utility territory, we recommend browsing DSIRE, the Database of State Incentives for Renewables & Efficiency.

PA Tier 1 RECs: You can sell RECs into the Pennsylvania market if the utility company is registered in PJM‑GATS. This will give you a higher value for your sale, given RECs are higher-priced due to the solar carve-out stipulations in its Renewable Portfolio Standard. Pennsylvania’s broader Tier I market allows RECs from any PJM‑registered resource—regardless of the generating state.

Want to know how incentives affect your total system cost?

Jump back to Section 4.1: Cost of Solar for a breakdown of how incentives can offset capital investment and shape ROI.

Are you a nonprofit interested in solar?

Visit Section 4.3: Financing to learn how Direct Pay, CollectiveSun, and other creative funding options make solar accessible for mission-driven organizations.